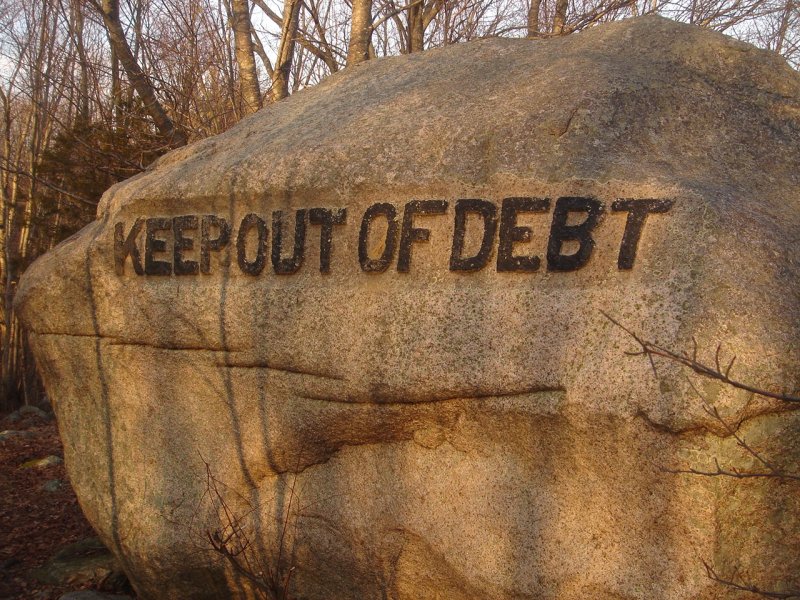

For some time I have wanted to express my opinion about debt. In 2006 I made the last payment on my mortgage and have been debt free since. So though you won’t get rich after reading what I have to say, you may be able to make some adjustments so that you can get out of debt faster. What I am writing here is really just a collection of what others have said and what I have done personally with my finances.

Plague

All I want you to do to begin with is to learn about plague. President J. Reuben Clark, Jr., advised:

“Let us avoid debt as we would avoid a plague; where we are now in debt let us get out of debt; if not today, then tomorrow. Let us straitly and strictly live within our incomes, and save a little.” (Conference Report, Apr. 1937, p. 26.)

After reading this I wondered what the plague was like. Knowing that would give me some measure of how bad debt can be. The Black Death struck in the fourteenth century killing an estimated 75-200 million people worldwide and killed 50% of the European population during a four-year period.

The classic sign of bubonic plague was the appearance of buboes in the groin, the neck and armpits, which oozed pus and bled. These buboes were caused by internal bleeding. Victims underwent damage to the skin and underlying tissue, until they were covered in dark blotches. Most victims died within four to seven days after infection. There was mortality rates of thirty to seventy-five percent and symptoms including fever of 101-105 °F, headaches, painful aching joints, nausea and vomiting, and a general feeling of malaise. Of those who contracted the bubonic plague, 4 out of 5 died within eight days. New research suggests Black Death is lying dormant. (See Wikipedia, Black Death)

In summary, debt is worse than the bubonic plague.

Credit Cards

Plan to never pay interest on credit cards or other high rate loans. Although I use credit cards, I have never paid interest. Not because I obtained a 0% loan but because I always pay off the balance.

Essentials

I have heard this preached over the pulpit for thirty-five years: If you must, borrow only for home, health, and education. Lest you feel alone, I will document some of my follies. In the past I have borrowed for a car and paid it back one or two years ahead of schedule. Now I pay cash for my vehicles. Against my better judgment I once borrowed for a vacation. It took me a long time to repay the loan which taught me better sense. Another time I borrowed to play the stock market. I got a margin call and although I was able to cover it by selling other stock, I liquidated all my remaining stocks and paid off my loans, managing to break even.

Charitable

If you are a Latter-day Saint you know well that you will not make any headway without paying your tithes and offerings. For others, find some money to help those with less. You will feel better and be more willing to sacrifice to pay debts.

Works for Me

The following are rules I use to guide me in my finances that haven’t already been mentioned.

- When I refinanced my mortgage I didn’t add to it more debt, even though my payments would have remained the same.

- When I had money saved that was sufficient to pay off my mortgage, I did so even if though the interest rate on my savings was higher than my mortgage.

- I never co-signed on a loan.

- I view a bargain as no bargain if I don’t need it.

- I never quit a job until I had other employment.

- I pay my bills as soon as they arrive.

- Driving an old rickety Mazda saved me enough money to become a home owner.

Questions

What works for you when it comes to money? Any debt stories? How successful have you been at teaching your children about money and debt?

I recently came accross your blog and have been reading along. I thought I would leave my first comment. I dont know what to say except that I have enjoyed reading. Nice blog.

Tim Ramsey

Tim,

Thank you for your kind comment, it is always helpful to get feedback. I am convinced that running a blog helps improve writing ability. I hope your week is pleasant.

Rick

I learned quite a bit from your posts under “money”. It’s often wise to take financial advice from someone that is better off than yourself, I’ve heard. Thanks!

Derek,

Well now, your kind words are encouraging me to write another “money” post. I do think you and Sarah have done well to be homeowners so early in life. You both are very sensible.

Rick

Good advice. What advice would you give for teaching young children and teenagers these principles? What works better than conventional strategies? What have you done with your children to teach them? What would you have changed (concerning teaching important financial principles) if you could raise your children again?

Good questions. They would be best answered in a post or posts of their own. Point your feed towards Rickety and I will answer those questions shortly.

I like your list of “Works for Me”. Nice list and rules.

Debt is indeed something else. We should all strive to live within our means. Peace.