Introducing writer David Brown, a content manager with a multinational corporation. David writes on a variety of news topics with a strong focus on finance. His interests include money related issues, entertainment news, and a blog The Book Haven.

The European Union might ask for Chinese help to end the ongoing debt crisis. Nicholas Sarkozy has been discussing the sovereign crisis with Chinese president Hu Jintao for quite some time. With Klaus Regling’s (the head of the European Financial Stability Facility — EFSF) visit to Beijing, the speculation has become more intense.

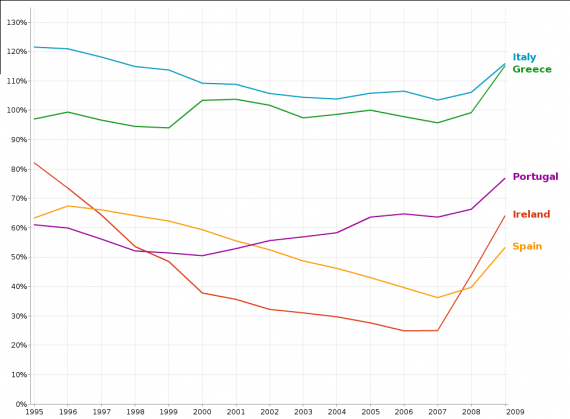

A lot of euro zone countries are trying to persuade China to make investments. It started with Greece and gradually Portugal, Spain and other core members of the euro zone approached China. This reflects the fact that the sovereign debt crisis in the continent is becoming more and more serious.

However, the Chinese have been fairly diplomatic. A lot of encouragement came from their end, but little investment followed.

But the situation is a bit different this time. Previously, investment in the euro zone meant undertaking a lot of risk. But now, China can invest in euro zone debt that is backed by EFSF. This means that China won’t be taking as much risk as the Europeans. However, the Europeans still can’t offer substantial protection in the current situation. China would certainly demand more details before they invest. They would also keep a watch on Greek bond swapping with private creditors.

It is possible that China will join other non-European nations to end this crisis. But will it bargain hard for political advantages for pumping cash into Europe? Not likely. This will make it publicly clear that Europe is not a fit place for investment and China is nothing more than a money machine; the image of Asian big boy will take a hit. Nonetheless, benefits like more representation at the IMF will eventually come because Europe desperately needs Chinese funding, especially for Spanish and Italian debt.

The price of help will also include the recognition of China as a “market economy.” This means that Europe will be vulnerable to cheap Chinese exports in the continent. It is difficult to predict how this will affect the European economy.

The Europeans might also be forced to abolish the export ban of armaments to the Asian economic giant. This might not be safe for world peace, but Europe possibly cannot call off the deal.