Four questions showed up recently in a comment about a post on debt.

1. What advice would you give for teaching young children and teenagers these principles?

First we need to identify the principles mentioned in the post. They are:

- Debt is worse than the plague.

- Never pay credit card interest.

- Borrow only for home, health, and education.

- Pay tithes and offerings.

- Be charitable.

- Never co-sign for a loan.

- A bargain is not a bargain if you don’t need it.

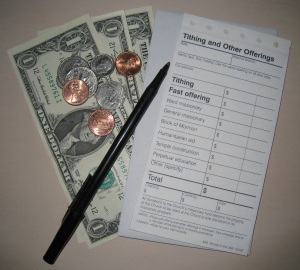

Obviously some of these principles would be lost on young children. The easiest principles to teach them would be tithes and offerings. When offerings such as for the Fast are made this is being charitable to the poor or those in temporary need. Number seven on our list can be taught by allowing safe but unwise purchases so that children can learn by their own experience what is and isn’t a bargain.

In our home we kept a small box that contained change in a small can and dollars in an envelope. It also contained tithing slips and envelopes. When the children received their allowance my wife and I would help them figure their tithing and write out the slip. We had change on hand (in the small can) so that they could submit the correct amount. By the time they were teenagers they took care of their tithes and offerings by themselves.

When the children reached twelve or thirteen I would open a credit union account for them complete with checks and a Visa debit card. Around eighteen I would make sure they got a credit card. That way they could start building a credit rating without me having to co-sign for a car. The credit card had a $200 limit which was raised over time.

Was it successful? The children know how to handle credit cards without incurring debt. They automatically pay tithes and offerings. They are very good savers.