The acronym PIIGS refers to the economies of Portugal, Italy, Ireland, Greece and Spain especially in regards to matters relating to sovereign debt and government deficits. These economies are seen to have high government debt levels and high government deficits relative to annual gross domestic product (GDP), despite being comparable with the Eurozone as a whole.

Some economies with similar financial problems, often notably the United Kingdom, are arbitrarily excluded. European Union member states are obliged to ensure their debt does not exceed 60 percent of their GDP.

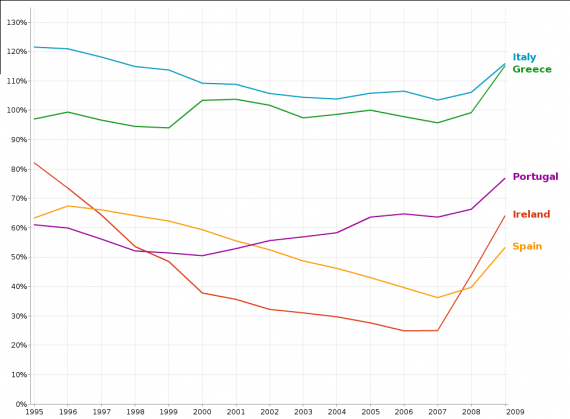

It will be interesting to examine the debt levels of the PIIGS compared with other countries in the European Union (EU). For this I am using Google Public Data Explorer with the Eurostat dataset. First the PIIGS government debt as a percentage of GDP:

Government debt is not supposed to exceed 60% of GDP. The PIIGS all exceed this except for Spain. But what of the EU as a whole? Observe:

The EU weighs in with a hefty 73.6%, worse than Ireland and Spain. Methinks there are more PIIGS in the sty.

We see that there are 12 EU countries over the 60% limit at the end of 2009. Spain, one of the PIIGS, is lower than them all and hence is not labelled. There are some large non-PIIGS economies in the top 12, namely France, Germany, and the United Kingdom. Notice that Belgium, Hungary, and France are at a higher percentage than PIIGS Portugal. Germany, Malta, the United Kingdom, and Austria also weigh in higher than PIIGS Ireland.

Is it any wonder that the Euro is dropping in value? The whole Eurozone is practically one gigantic PIIGS sty. But the EU is not alone — the U.S. gross debt is 87% of GDP.

Play with the numbers yourself at Google Public Data Explorer. I have set it up to start with the PIIGS economies but you can add in more of the EU countries.